Mint.com is a personal finance site that is free to use. It basically takes your login information from all of your accounts (you have to provide it and be able to do online banking) and automatically sorts each transaction into your budget, organizes goals, and tells you where you can be saving money. Most people I chat about this with (including Mark and me when we first heard about it) wonder if it's safe. So far, it has definitely been safe! It's just like any other banking website that you trust to handle your finances, and in this case it's just giving you access to all of those accounts in one place. I found this article that might help you make a decision on whether it's right for your family or not. If you're still not sure, do your own research! There are a ton of articles discussing the topic and I'm sure you can find a good answer.

Let's get started!

This is the home page:

(I've obviously whited out sensitive information, all containing dollar amounts. I left some in just so you can see how we budget. I don't think that's super sensitive information. Our account numbers aren't displayed here. If you catch something I should white out, please let me know.)

So Mark and I have gone in and entered all of our account information : checking, savings, credit cards, loans, investments, and property (our house isn't included as property) which shows up on the left side. Once you login, these accounts take about a minute to update with your current information.

At the top right, mint shows your alerts for upcoming bills. Under alerts, the content will vary. Right now ours is alerting us of bills due, but sometimes there are ways you can save, etc displayed here. Under that, it displays your budget. This is the thing that we pay the most attention to. When you first sign up, you have to go in and set up your budgets. It takes a few months to get this right if you don't know what you're spending day to day. As you go through the month, all of your transactions will get assigned to your different budget categories and as you see, will display as 'green' (meaning you are in the clear), 'yellow' (meaning you are close to hitting your budget) and 'red' (meaning you are over budget). You can set up email or text notifications informing you if you go over or are close to going over.

To the left of budgets, you'll see your trends and net income. This is a good overall view to see your cash to debt ratio as well as your monthly spending habits.

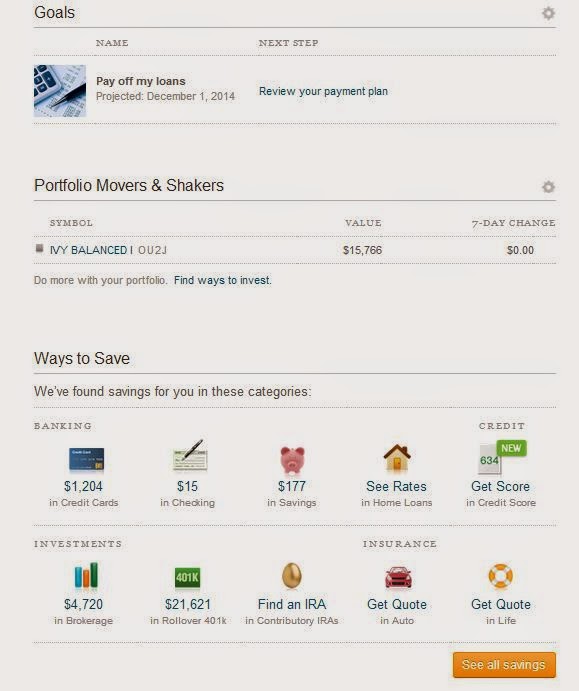

Underneath your budgets (shown below), mint provides suggestions of ways to save and they estimate what you could be saving. This is especially helpful (I think) for people who are banking but aren't getting rewards (like credit card points, etc). This section recently kicked off a conversation about transferring our savings account to a bank that offered more interest.

You can also set goals for yourself. As you can see, our goal is to pay off debt. You put in how much you want to pay each month and it calculates when it will be paid off and it also keeps track of it as you go!

So that's the recap of the home page.

Once you have all of your accounts set up, then mint starts tracking your every move. Under 'transactions', you can go in and see everything as it comes in. In the first couple of months, you will have to manually change the categories so mint can start recognizing what budget category it belongs in. For instance, anything relating to sports or disc golf typically goes in Mark-Shopping and anything from Nordstrom goes into Diana-Shopping. :)

Tabs for navigating through your site

So every few days we go into that list and make sure everything is going to the right place. We also both have the iPhone app so we can keep up with it day to day.

update: I forgot to mention that you can also split your purchases. If you look at the image above, it displays date, description, category, has the little arrow symbols, and amount. The split arrow is for 'split'. For instance, once that Target charge clears (it is pending right now, usually for 2-3 days) Mark or I will go in and split it into different categories. I don't remember exactly what we purchased that day, but I keep track of receipts that I know will apply to multiple categories (I hate keeping receipts so those are the only ones I hang on to). When you hit the split button, it pops up with a window where you can select from all of your categories and split each transaction into however many categories you want. This can seem a little tedious at times, but if you are getting specific with your budgeting, it's helpful to know exactly how much you're spending on dog food, etc rather than lumping everything into "groceries".

We've had mint.com for over 2 years and we do all of our budgeting this way. It's super visual and precise and I highly recommend it to anyone that wants to try something new! It's definitely made us be more aware of where our money goes, as well as alerting us when we are close to going over budget so we know to scale back and NOT go out to eat that day, etc.

Please email me with any questions or comment below if you've used mint before!

No comments :

Post a Comment

Hey friends! We would LOVE to hear your thoughts and ideas! Share 'em here!